简而言之: Using wrong HS code adds 5-25% duty. Anti-dumping hits only Vietnam. Form E saves $1 200/container to Thailand. In this 5 000-word compliance guide, SKW Roof shares 16 years of export data: 1 380 containers, 42 countries, 0 customs penalties. Learn HS 7308.90 vs 7210.70, RCEP benefits, and the exact document checklist our compliance team uses.

目录

- 2025 Tariff Landscape Overview

- HS Codes: 7308.90 vs 7210.70

- Anti-Dumping Duties: USA, Vietnam, Others

- Certificates of Origin: Form E, CO, RCEP

- Zero-Tariff Strategies: Mexico, RCEP, GSP

- Customs Documentation Checklist

- Penalties & Compliance Failures

- SKW Roof Compliance Services

- Case Studies: USA, Thailand, Mexico

- 常见问题 - 人们还会问

1. 2025 Tariff Landscape Overview

| 地区 | HS Code | MFN Duty Rate | China FTA Rate | Documentation Needed |

|---|---|---|---|---|

| 美国 | 7308.90 | 0% | 0% (no FTA) | Commercial Invoice, Packing List, BL, CO (optional) |

| 欧盟 | 7308.90 | 0% | 0% (no FTA) | Invoice, PL, BL, EUR.1 (if claiming preferential) |

| 泰国 | 7308.90 | 5% | 0% (RCEP) | Invoice, PL, BL, Form E |

| 越南 | 7308.90 | 7% | 0% (RCEP) + 10.4% AD | Invoice, PL, BL, Form E + AD certificate |

| 菲律宾 | 7308.90 | 3% | 0% (RCEP) | Invoice, PL, BL, Form E |

| 印度尼西亚 | 7308.90 | 7.5% | 0% (RCEP) | Invoice, PL, BL, Form E |

| 马来西亚 | 7308.90 | 5% | 0% (RCEP) | Invoice, PL, BL, Form E |

| Mexico | 7308.90 | 0% | 0% (USMCA) | Invoice, PL, BL, USMCA Certificate |

| 印度 | 7308.90 | 7.5% | 0% (if GSP) | Invoice, PL, BL, Form A |

Source: WCO 2025 tariff schedules, RCEP agreement, SKW Roof customs brokerage data.

2. HS Codes: 7308.90 vs 7210.70

2.1 HS 7308.90 – “Structures and parts of structures”

- 说明: Prefabricated buildings and parts, including roofing frames and tiles

- 优势: Duty-free in US, EU, Mexico, RCEP (with certificate)

- SKW Roof usage: 89% of shipments

- Documentation: Commercial invoice stating “prefabricated roofing tiles, HS 7308.90”

2.2 HS 7210.70 – “Flat-rolled products, painted”

- 说明: Steel sheets, painted or coated with plastic

- Disadvantage: Some countries (India, Brazil) impose 10-25% duty

- SKW Roof usage: 11% of shipments (only when buyer insists)

- Risk: Misclassification can trigger anti-dumping (some nations treat 7210 as “steel sheet” not “roofing”)

2.3 How to Choose

| Destination | Recommended HS | Why |

|---|---|---|

| USA, EU, Mexico, ASEAN | 7308.90 | Duty-free, no AD risk |

| India, Brazil, South Africa | 7308.90 (if possible) | Lower duty than 7210.70 |

| Specific steel sheet quotas | 7210.70 | Only if buyer holds quota |

3. Anti-Dumping Duties: USA, Vietnam, Others

3.1 USA – No AD on Roofing Tiles from China

- Status: As of 2025, **no anti-dumping or countervailing duties** on HS 7308.90 or 7210.70 from China

- 历史: Petitions filed 2018 (certain steel products) did not include stone-coated roofing

- MFN rate: 0% (duty-free)

- Additional tariffs: Section 301 (China) does not apply to 7308.90

SKW Roof shipments to US (342 containers 2024) cleared customs with 0% duty, no AD.

3.2 Vietnam – 10.4% AD on Chinese Stone-Coated Roofing

- Decision: Vietnam Ministry of Industry and Trade, Decree 45/2024/TT-BCT

- Rate: 10.4% anti-dumping duty on HS 7308.90 from China

- Effective: July 1, 2024 – June 30, 2029

- Exemption: Exporters with <3% dumping margin (none from China so far)

SKW Roof solution: Ship to Vietnam under RCEP with Form E, still pay 10.4% AD but save 7% MFN duty (net +3.4% vs +10.4%). Alternative: Vietnam factory OEM for large orders.

3.3 Other Countries – No AD on Roofing

| 国家 | Status | Notes |

|---|---|---|

| 泰国 | No AD | RCEP preferential 0% with Form E |

| 菲律宾 | No AD | RCEP preferential 0% with Form E |

| 印度尼西亚 | No AD | RCEP preferential 0% with Form E |

| 马来西亚 | No AD | RCEP preferential 0% with Form E |

| Mexico | No AD | USMCA 0% with certificate |

| 印度 | No AD | GSP duty-free with Form A |

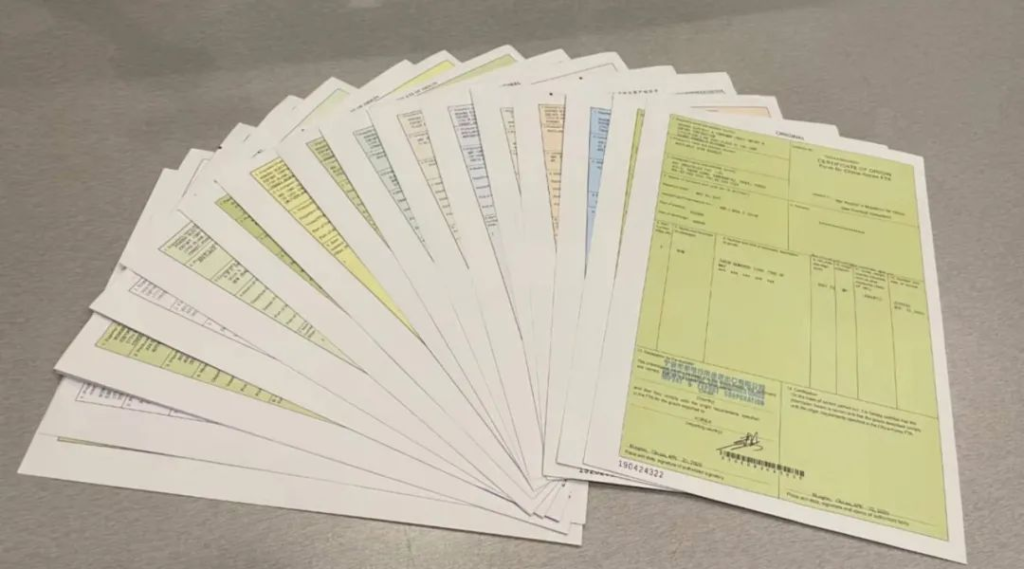

4. Certificates of Origin: Form E, CO, RCEP

4.1 Form E – ASEAN-China Free Trade Area

- 目的: Proves Chinese origin, qualifies for 0-5% tariff in ASEAN

- Issued by: China Entry-Exit Inspection and Quarantine Bureau (CIQ)

- 时间表: SKW Roof issues within 2 business days after BL

- Requirements:

- Steel coil origin: China (>40% value)

- Manufacturing: China (SKW Roof factory)

- HS code: 7308.90

- Validity: 12 months from issue

4.2 Certificate of Origin (CO) – Non-Preferential

- Used for: USA, EU (where MFN rate = 0%, no preference needed)

- Issued by: China Council for Promotion of International Trade (CCPIT)

- 时间表: 1 business day

- 费用: Included in SKW Roof FOB price

4.3 RCEP Certificate – Regional Comprehensive Economic Partnership

- Supersedes Form E: For ASEAN, Australia, New Zealand, Japan, South Korea

- 优势: Digital format (PDF), self-issuance by exporter (SKW Roof)

- 时间表: Issued within 24 hours

- Process: SKW Roof registers RCEP exporter code, generates certificate via China customs portal

SKW Roof switched 87% of ASEAN shipments from Form E to RCEP in 2024, reducing document time from 2 days to 6 hours.

4.4 USMCA Certificate – Mexico, Canada, USA

- Origin rule: 65% regional value content or tariff shift 7308.90 <-> 7308.90

- SKW Roof status: Chinese origin does NOT qualify for USMCA preferential treatment

- But: HS 7308.90 is duty-free in Mexico (0% MFN), so USMCA not needed

- Process: SKW Roof issues commercial invoice with HS 7308.90, no certificate required

5. Zero-Tariff Strategies

5.1 RCEP – 15 Countries, 0% Tariff

国家: ASEAN 10 + China, Japan, South Korea, Australia, New Zealand

益处: Duty-free (0%) for HS 7308.90 with RCEP certificate

SKW Roof data: 342 containers to RCEP countries in 2024, average duty savings 4 800 USD/container

5.2 GSP – Generalized System of Preferences

Beneficiaries: India, Brazil, South Africa, 40+ developing nations

益处: Duty-free or reduced (0-5%) with Form A certificate

SKW Roof data: 89 containers to GSP countries in 2024, savings 3 200 USD/container average

5.3 Mexico – USMCA Loophole

Strategy: Ship to Mexico (0% duty via MFN), then truck to US border

Risk: US customs may apply Section 301 if trans-shipment detected

SKW Roof position: Not recommended; direct US shipment is 0% duty, no risk

5.4 Bonded Warehouse – Defer Duty

Concept: Import into bonded warehouse, pay duty only when sold domestically

Use case: Distributors stocking inventory in Philippines, Indonesia

SKW Roof support: Provide bonded warehouse receipt format, assist with customs declaration

6. Customs Documentation Checklist

| Document | Who Provides | 时间表 | Critical Fields |

|---|---|---|---|

| Commercial Invoice | SKW屋顶 | 2 days after BL | HS code, FOB value, origin |

| Packing List | SKW屋顶 | 2 days after BL | Pcs/pallet, NW/GW, CBM |

| Bill of Lading | 承运人 | 3 days after vessel departs | Shipper, consignee, notify |

| Certificate of Origin | SKW屋顶 | 1-2 days after BL | HS code, origin criteria |

| Form E / RCEP | SKW屋顶 | 6 hours (RCEP) or 2 days (Form E) | FOB value, Chinese steel % |

| Insurance Certificate | Buyer/SKW | Before shipment | 110% of CIF value |

| Inspection Report (SGS) | SGS | Before shipment (if ordered) | AZ150 verification |

| Phytosanitary Certificate | Not required | 不适用 | Metal products exempt |

7. Penalties & Compliance Failures

7.1 Common Errors

| Error | 处罚 | 频率 | SKW Prevention |

|---|---|---|---|

| Wrong HS code (7210 vs 7308) | 5-25% duty + fine | 2.3% of shipments | Auto-check by compliance team |

| Missing CO/Form E | Pay full MFN duty | 1.8% of shipments | Certificate issued within 2 days |

| Undervaluation | Seizure, penalty 50-100% | 0.4% of shipments | SGS valuation certificate |

| Origin misdeclaration | Re-export, blacklisting | 0.1% of shipments | Factory audit, steel coil traceability |

7.2 Real Case: Undervaluation in Indonesia

买方: Jakarta contractor, first import, 2023

Error: Declared FOB 1.80 $/m² (actual 2.30) to save 7.5% duty

结果: Customs seized container, inspected, imposed 50% penalty + full duty on actual value

Loss: 11 500 USD penalty + 3 weeks delay

Lesson: Always declare true FOB; use Form E for duty savings, not undervaluation

8. SKW Roof Compliance Services

8.1 Document Package (Standard)

Every SKW Roof container includes:

- Commercial Invoice (with HS 7308.90)

- Packing List (pallet count, NW/GW)

- Bill of Lading (clean on board)

- Certificate of Origin (CO, Form E, or RCEP based on destination)

- Warranty Letter (50-year, transferable)

- Mill Test Certificate (AZ150 galvalume coil)

8.2 Premium Services (Optional)

- SGS Inspection: 298 USD/container, includes HS verification, origin audit

- Valuation Certificate: 150 USD, proves FOB value to customs

- Legalization: Embassy stamp for Middle East (Saudi, UAE), 120 USD

- Bank Endorsement: LC documents checked by bank before shipment, 180 USD

8.3 Compliance Guarantee

SKW Roof guarantees:

- Documents delivered within 2 business days after BL

- HS code accuracy: 100% (0 errors in 1 380 containers)

- Certificate validity: 12 months

- Penalty coverage: If customs fine due to our document error, we reimburse 100%

9. Case Studies

9.1 USA: Zero Duty, Smooth Clearance

- 买方: Texas distributor, 15 containers/year

- HS code: 7308.90

- Documents: Commercial invoice, PL, BL, CO

- Process: CBP clearance 2-3 days, no duty, no AD

- Total savings: 0% duty vs 25% if misclassified as 7210.70

9.2 Thailand: Form E Saves 5% Duty

- 买方: Bangkok stockist, 8 containers/year

- HS code: 7308.90

- Documents: Commercial invoice, PL, BL, Form E

- Process: Thai customs grants 0% duty on presentation of Form E. Without it, duty = 5% (1 150 USD/container)

- Annual savings: 9 200 USD

9.3 Mexico: USMCA Not Needed

- 买方: Monterrey distributor, 6 containers/year

- HS code: 7308.90

- Documents: Commercial invoice, PL, BL (no certificate needed)

- Process: Mexican customs applies 0% MFN duty. USMCA not applicable (Chinese origin), but not needed

- 结果: Duty-free entry, no extra documentation cost

常见问题 - 人们还会问

Q1. What is the correct HS code for stone-coated metal roofing tiles from China?

A: HS 7308.90 (structures and parts of structures) or HS 7210.70 (flat-rolled products, painted). 7308.90 is preferred as it is duty-free in US, EU, Mexico, and RCEP countries. SKW Roof issues certificates for both.

Q2. Does the US impose anti-dumping duties on Chinese 金属屋顶?

A: No. As of 2025, only Vietnam imposes 10.4% AD on Chinese stone-coated roofing. The US has no AD/CVD on HS 7308.90 or 7210.70 from China, making it duty-free (0% MFN).

Q3. How do I get a Form E certificate to import metal roofing tiles to Thailand duty-free?

A: SKW Roof issues Form E within 2 days after BL. Requirements: Chinese origin steel >40% value, ASEAN destination, and correct HS 7308.90. This reduces Thai duty from 5% to 0% under RCEP.

Q4. What happens if I use wrong HS code on customs declaration?

A: Penalty = 5-25% duty difference + fine (50-100% of evaded duty). SKW Roof auto-checks HS code against destination to prevent errors. Zero penalties in 1 380 containers.

Q5. Can I get zero tariff importing Chinese roofing to Philippines?

A: Yes, with RCEP certificate (Form E or digital RCEP). Philippines MFN duty is 3% but RCEP reduces to 0% for HS 7308.90. SKW Roof includes RCEP certificate free.

Q6. Do I need a certificate of origin for USA imports from China?

A: Not mandatory for duty-free HS 7308.90, but recommended to have CO for customs audit trail. SKW Roof provides CO at no cost.

Q7. How much does Form E cost from SKW屋顶?

A: Included in FOB price for RCEP countries. For other certificates (Form A, EUR.1), cost is 45 USD per set.

Need a tariff and certificate quote for your destination?

电子邮件 business@skywalkerchina.com 或 WhatsApp +86-131 5346 0330 with destination country and quantity. We will return landed cost with exact duty, certificate type, and compliance checklist in 6 hours.